Personal income was up +0.5% for December, a bit more than expected, while spending was flat. The consumer savings rate increased from a fairly steady 3.5% to 4.0% for December. Core PCE inflation was a bit higher than forecast, resulting in a +1.8% year-over-year rate.

The Case-Shiller home price index declined a seasonally-adjusted -0.7% in November, which was a bit more than expected and translated to a year-over-year decline of -3.7%. While several Midwest/west cities like Phoenix and Denver saw gains, Chicago and Detroit continued to see weaker housing conditions. In reviewing a recent piece on housing prices across the U.S., U.K., Canada and Australia (among a few others), it was interesting to see that the American average ratio of median home price to median household income across 200 major markets stood at 3.0, which is just at the high side of the long-term average and the cheapest of the group of nations surveyed. Of course, the U.S. is an extremely bifurcated market, with continued extremely expensive conditions in coastal areas like California and New York, and less expensive conditions in the Midwest and South, based on these metrics. Construction spending rose +1.5% in December, which was more than most analysts expected. The major gains came from ‘private non-residential building,’ although housing also rose a bit.

Consumer confidence declined in January from 64.5 to 61.1, which was a bit unexpected and a result of lower scores on ‘current conditions’ as opposed to ‘expectations.’

On the business side, the Institute for Supply Management (ISM) manufacturing index rose to 54.1 for January, which was a bit higher than the revised December number. The new orders component gained the most in the series, and inventories contributed. The ISM non-manufacturing index jumped from 53.0 to 56.8 in January, and included gains in all aspects of the report, from business activity to new orders to employment. Both reports have been consistent with modest growth in economic activity.

Nonfarm productivity growth increased by an annualized +0.7%, quarter-over-quarter in Q4. Labor costs were up about a percent also. These aren’t often a high-profile number, but trends here bear watching due to their connection to inflationary effects. Factory orders increased by +1.1% net, with better shipments but lower inventory growth.

On the employment front, the ADP forecast of private employment growth showed +170,000 jobs for January, a bit below the expected +182,000 number. This forecast is a combination of their own proprietary database information with some publicly available government data. Due to some end-of-year adjustments that can look a little strange, the number is not far off the mark and is generally in line with trend.

Initial jobless claims for the last week in January came in at 367,000, down from the previous 379,000 and was lower than anticipated. These numbers, which are reported weekly, can obviously be choppy, but the more closely watched four-week moving average trend has continued to move lower, as it has for the past several months. Continuing claims were down 130,000 from the prior week. It may not ‘feel’ like it for many, but the labor market has made strides in improvement.

The nonfarm payroll employment report on Friday showed an increase of 243,000 jobs, which is about 40,000 more than expected and reflects broad gains across a variety of sectors. Manufacturing and construction jobs were added, which previously showed less momentum. Additionally, the closely watched unemployment rate fell to 8.3%. From a sentiment standpoint, this is significant, as this rate is generally reported as headline news in the evening of its release. It is turning points like this that may cause the jobs situation to finally ‘feel’ better and result in continued positive sentiment, as sentiment is entirely based on perception of the current and future environment.

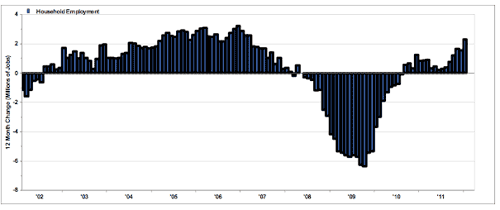

This chart shows the 12-month change in household employment, which we think is quite instructive in showing the current trend. Slowly, the employment picture has indeed been improving.

Source: Payden & Rygel

Market Notes

| Period ending 2/3/2012 |

1 Week (%) |

YTD (%) |

| DJIA |

1.62 |

5.46 |

| S&P 500 |

2.22 |

7.11 |

| Russell 2000 |

4.05 |

12.25 |

| MSCI-EAFE |

2.27 |

8.36 |

| MSCI-EM |

3.12 |

14.40 |

| BarCap U.S. Aggregate |

-0.06 |

0.45 |

| U.S. Treasury Yields |

3 Mo. |

2 Yr. |

5 Yr. |

10 Yr. |

30 Yr. |

| 12/30/2011 |

0.02 |

0.25 |

0.83 |

1.89 |

2.89 |

| 1/27/2012 |

0.06 |

0.22 |

0.75 |

1.93 |

3.07 |

| 2/3/2012 |

0.08 |

0.23 |

0.78 |

1.97 |

3.13 |

Risk assets led the way last week. U.S. stocks gained strongly in line with the positive economic data releases, lower unemployment and moderate if not spectacular company earnings due to tougher comparisons year-over-year. Regardless of the moderate headlines, and half of S&P companies reporting, two-thirds have beaten estimates. Facebook filed for its initial IPO this week, although the target was lowered from $10 billion to $5 billion.

In keeping with the strong markets, small-caps gained the most. Financials, telecom and technology were the best performing industries of the week, while defensive utilities, staples and health care lagged. Emerging markets led the foreign markets, but the EAFE also outperformed domestic markets as investors saw glimmers of hope in a Greek debt deal.

In last week’s ‘risk-on’ environment, U.S. treasury bonds lost ground and yields rose. Credit, such as convertibles, investment-grade corporate and bank loans, gained ground. Foreign debt of both the developed and emerging market variety was also up.

Commodity contracts were largely down due to pullbacks in crude oil and natural gas, as were gold and other metals.

Enjoy the week.

Karl Schroeder, RFC, CSA, CEP

Investment Advisor Representative

Schroeder Financial Services, Inc.

480-895-0611

Sources: FocusPoint Solutions, Barclays Capital, Bloomberg, Deutsche Bank, Goldman Sachs, JPMorgan Asset Management, Morgan Stanley, MSCI, Morningstar, Northern Trust, Oppenheimer Funds, Payden & Rygel, PIMCO, Reuters, Standard & Poor’s, U.S. Federal Reserve, Wells Capital Management, Yahoo!. Index performance is shown as total return, which includes dividends, with the exception of MSCI-EM, which is quoted as price return/excluding dividends. Performance for the MSCI-EAFE and MSCI-EM indexes is quoted in U.S. Dollar investor terms.

The information above has been obtained from sources considered reliable, but no representation is made as to its completeness, accuracy or timeliness. All information and opinions expressed are subject to change without notice. Information provided in this report is not intended to be, and should not be construed as, investment, legal or tax advice; and does not constitute an offer, or a solicitation of any offer, to buy or sell any security, investment or other product. Schroeder Financial Services, Inc. is a registered investment advisor.